Group 2 - Investment Portal

Contents

Project Description

Simple step-by-step information sharing portal giving an overview of financial investing, investment strategies and steps to invest for novices/beginners i.e. people who have never invested before and don't know how to go about it.

Contextual Inquiry (CI)

In the Contextual Enquiry stage we used 3 methods- Survey, Interview, and Observation.

The survey was a simple Google form which covered a lot of topics. The survey was built in two parts. Part 1 collected demographics and general information about our users, such as age, gender, employment status, and years of experiences. Part 2 asked questions specific to our platform entailing the users' level of investing experience, their investment goals and preferences, and the kind of information they would like to know. These survey gave us statistical insights. The interview method expanded upon the same questions as the survey but with the aim to gain qualitative insights into our user preferences and needs. The interviews were done over Zoom with screen recording after interviewees gave verbal consent. The recordings helped to review the interviews and tasks to make observational notes. The three methods gave us a preliminary understanding of the needs and desires of the users with regards to the investing platform.

Survey

Participants- 15

Tool- Google Survey

What was the aim?

- The aim of the survey was to gain basic information form our participants regarding their interest, experience, expectations, etc with regards to investing.

- We wanted to get an overview of our target population with an insight about their preferences.

How was the aim achieved?

- A list of structured questions was forwarded to 15 people.

- A short Google Form was made for easy answering.

- Answering the survey took maximum 15 mins.

Results

- 53.3% and 46.7% of our participants had little experience investing and had no investing experience respectively.

- More than 50% of the participants were interested in investing so that they can save for a goal.

- 80% of the participants wanted advice about investing correctly.

Other results gave us an insight about how the participants would like to use our app and the goals they would like to achieve.

Interview

Participants- 12

Tools- Zoom

What was the aim?

- The aim of conducting a detailed interview with the participants was to dig deep into their motivation to invest.

The topics users were asked to elaborate on:

1. What is your level of investing experience?

2. Why are you interested in investing?

3. What is the reason you haven’t invested yet?

4. Which of these questions would you like to know the answers to?

5. Would having well-researched information about financial investment encourage you to invest as well?

6. How much information would you like to receive with regards to financial investment?

7. Which source of information is your preferred way of receiving investment information and advice?

8. If you consider investing, how much risk are you willing to take?

9. How active do you imagine yourself being in maintaining your own financial portfolios?

10. How would a Financial Portal or App be beneficial to you?

How was the aim achieved?

- The questions from the survey were kept in mind and a list of semi-structured questions was developed. This let us guide and moderate the interview without restricting the storytelling flow of the interviewees. After receiving an oral consent to record the interview, the interview began. The agenda and possibility of there being a task to do were shared with the interviewees. The duration of the interviews ranged from 45 to 60 minutes.

Results:

- The Contextual Inquiry led us to classify our participants into two groups - Experienced and Inexperienced.

The Contextual inquiry gave us the following information:

Experienced Participants:

- These participants have little knowledge about investing.

- The gained their knowledge by using different financial news platforms and a few of them have tried to invest.

- Experienced participants either did not have extra capital to invest or were waiting for the next stock market crash.

- These participants wanted either elaborate information or a few options curated to their goals.

- On an average, most of the participants were moderate risk-takers with one high-risker participant being an outlier.

- On an average all the participants would like to collaborate with an advisor while making financial decisions.

Inexperienced Participants:

- These participants had no prior investing knowledge.

- The reason for their lack of knowledge was the availability of too much information and no income.

- These participants either preferred few options curated to their goals or an advisor handling their finances.

- While some participants were moderate risk-takers, there were a couple who were conservative.

Observations

This task was conducted as a part of the interview.

Participants- 12

Tools- Zoom

What was the aim?

- To observe how the participants interact with existing online investment platforms.

- To find out which other investment already exist and how participants interact with them.

- To see if the participants had any issues or problems navigating those platforms so we can try to solve them or avoid having the same problems.

How was the aim achieved?

- Using the screen sharing option on Zoom, the participants were asked to use a platform they use to gain information from.

- The participants were asked to talk the interviewer through the task and share their thoughts.

- Lists were made post-task of all the problems the participant verbalized or seemed to have while navigating the platform.

- Quotes from the participant were also noted.

Problem List with Robinhood:

- I don’t look at it that much

- Looks different than the mobile app

- I invested a little bit just to see what it’s like - 5 dollars

- Confusion about what the circle graphs and the percentages mean

- I don’t know what equity means even though they showed that in the scores in my portfolio

- Has a instant deposit limit but it might be dependent on how much I use the app

- Bank account is linked so I can withdraw my money - but couldn’t find it

- Graphs visible but weren’t able to read it well or easily and were confusing - goes right to left, instead of left to right

- Expanded charts are also confusion - lots of “maybe”

- Can type in an industry name in search, but not on any page: “it’s so hard”

- A company profile shows up with details and with similar suggested searches and “related lists”

- There is some estimated cost or market price per share - can use the “buying power” from other stocks or shares

- There are some ? to give more info but full of jargon which needed to be deciphered

- Lots of guesswork about what words mean and graphs might be

- Now idea how cryptocurrency works but it comes up as suggestions

Problem List with TradeRepubic:

- Don't like the colours

- Everything is in German

- Google translate setting worked to translate everything

- Tried making an account but US citizens can’t make accounts

- SMS was sent to her number for verification which took some time

- Answered a lot of questions, and in the very end it says that US-persons can’t use TR at the moment.

- Had to go through lots of FAQ lists to figure out why but no clear answer

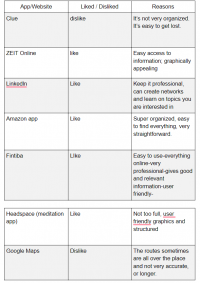

Results:

This task gave us the opportunity to understand how the participants interact with various platforms and their preferences with regard to the platform they are using.

Personas

Based on the results of the Survey and the Interviews, we split our participants into two groups categorized on their prior knowledge and experience in investing -

1. Experienced

2. Inexperienced

Followed by which, we created two personas, which represent these groups.

The personas helped us create our focus groups: one for the experienced users and one for the inexperienced users. We were also able to create tasks and modify them for each focus group based on these personas.

Focus Group

Purpose & Objectives

The purpose of the Focus Group was to engage with our potential users in order to find out further needs of future investors. We decided to divide groups into two, in order to see what could be the difference in the needs of non-experienced participants vs experienced ones and to understand how their needs and ideas overlap. The goals of focus groups were to explore desired functions of investment app, to understand what expectations they would have from the app and also to see how relevant/irrelevant questions and functions of the app would be. Most of all, we want to have some ideation rounds to come up with collaborative ideas for the design of our app.

Participants

Focus Group 1 (experienced): Date: May 15, 2020

Moderators: Shrekha, Michael

Time and Observer: Ani and Emre

Participants: 5

Total time: 1:25 hrs

Group 2 (inexperienced):

Date: May 16, 2020

Moderators: Shrekha & Michael

Time and Observer: Liz and Vedanti

Participants: 4

Total time: 1:15 hrs

Procedure & Activities

Introduction

Moderators shared the agenda and timeline of the session so the participants know what to expect. They informed the participants that the Session is not being recorded and that’s why we have note-takers on the call. The Introduction round of all the participants involved sharing their name, where they are from, how are they feeling and if they've been in a focus group before. Duration: ~10 minutes.

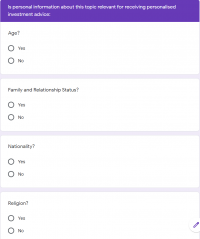

Task 1: Relevance

Google form was shared with the participants. The question we wanted to be answered was: Which of these questions should influence the investment advice and which are irrelevant. For different topics, the participants simply answered with Yes or No. The Moderators shared the statistics created by the responses of the google form with the participants for a short discussion. Duration: ~10 minutes.

Task 2: Ideation

The Ideation round was split into two parts. We used Menti as the platform for both rounds.

Part one: The purpose of this part was to collect ideas for the different aspects the app would potentially have.

The question we asked was: What are the 3-5 things you would love to have in the app? The moderators shared a Menti link with the participants. For 5 minds, the participants brainstormed. Simultaneously, a word-cloud was being formed with the input. The result included many different relevant words. The moderators held a short conversation with the participants to try and finalize three to five aspects to focus on for the next part. The conclusion was reached by a simple vote amongst the participants.

Part two: The purpose of this part was to collect ideas about the interaction part of the aspects finalized in the previous part.

The question we asked was: How will these aspects interact? The moderators shared a second Menti link with the participants. This was a form. Each entry by the participants created its own thought bubbles. The creation of the thought bubbles was followed by a lengthy discussion about the ideas that complement each other, don't work as well together, are not very useful to the users, etc.

Duration: ~ 30 minutes.

Task 3: Card Sorting

In this task, we tried to make Card Sorting virtual by using Google Slides where each slide would substitute a card.

The Master Slides were created by putting the following actions on a slide each:

- Attach bank account

- Read articles or blogs

- Get advice on best investment option for me

- Answer questions about my investment style

- Look for market trends

- Examine company performance

- Read company profile with information

- Buy and sell shares

- Set-up savings plan (systematic investment plan?)

- See graphs about my share’s performance

- Set investment goal and see the progress

- Filter companies and them to a “watch list”

- See my transaction history

- Interact with a chatbot or personal advisor

- Invite friends and referrals

A duplicate for each Master Slide was created for each participant so they could edit and make changes them to their slides without any hesitation. The Master Slides could then be used to compare against the Participant Slides.

These actions were shuffled, and the participants were given the following instruction: "In this task, you have been given one action on each slide. They are in no particular order but just a list of actions we think a user might do while interacting with our app. Your task is to drag and rearrange all the slides in the order a user might act while using our app. You are also allowed to: delete slides you think are irrelevant, add new action slides if something is missing, and make an existing or new action optional (put the word “optional” in brackets)."

The moderators asked the participants to use the Grid View to make the card sorting easier. Duration: ~10 minutes.

Feedback and Wrap-up

As a wrap-up exercise, we asked the groups to a short exercise. The experienced group were asked to choose a platform they already use and make a list of things they like and dislike about those platforms. For the inexperienced group, they were asked to choose any platform in their phone and do the same exercise. The goal was to have a comprehensive list of the things they dislike about existing apps so that we don’t make the same mistakes while designing. This was done on a Google Doc. The next page on the same Google Doc asked for feedback - they could share any questions, thoughts and ideas they may have.

The session ended by thanking them for their participation.

Findings

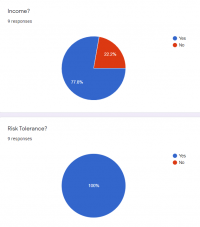

Results of Task 1

Total respondents: 9

Statistics for each topic:

- Age: 88.9% YES

- Family and Relationship Status: 55.6% NO

- Nationality: 55.6% NO

- Religion: 77.8% NO

- Hair colour: 88.9% NO

- Income: 77.8% YES

- Risk Tolerance: 100% YES

- Duration of Investment: 100% YES

- Environmental Values: 77.8% YES

- View on Human Rights: 55.6% YES

- Level of Education: 55.6% NO

- Field of Work: 55.6% NO

- Employment Status: 55.6% YES

- Place of Residence: 55.6% YES

- Investing Experience: 77.8% YES

- Hobbies: 66.7% NO

- Car Ownership: 77.8% NO

- Home Ownership: 66.7% NO

- Investment Goal: 100% YES

There was 100% agreement from all respondents on the relevance of the following topics: Risk Tolerance, Duration of Investment, Investment Goal.

Results of Task 2

Group 1:

- An investing app should be transparent as much as possible and should give you all directions.

- The platform should tell you which stocks are reasonable or the other way around.

- If you are going to invest in the wrong one then it should give a warning about it and advise you that it’s not reasonable in order to invest in the right company and prevent you from making investment mistakes.

- The app should inform you about regulations / legal obligations such as tax obligations etc.

- The App should have daily updates, every minute. Otherwise, your investment might crush.

- You need to know about the company to invest: what's the review, margin, profit, etc. as many info as possible. After investment getting news about the company, what the CEO said, etc since it’s a public company and it might affect your investment.

- Transparency, but not much, in that case, the amount would be very high.

- Wants to see a bar to see how good his investment was. See the chart of his past investments.

- The Platform should be transparent, wants to have logic chains, reasons why to invest.

- The app should tell you is something is not relevant, and should advise you an alternative, more beneficial stock to invest.

- You, platform and advisor should think together. The platform should tell you if you are not gonna get any profit.

Group 2:

- To assess the risk, my own view on it and guidance through experts + other users.

- Updates about new entries: people entering the industry.

- Important that the company values match with mine, but not sure if it’s smart/feasible or not.

- Employment status is important because it says how much I can invest or not, but the field of work doesn’t matter.

- Nationality is important: if you’re from another country and want to invest in another, especially about how those markets work because it might be different for you.

- I would want to be informed about the risk before I take my decisions.

- The more information I have the better to encourage me to invest so you know what you’re getting into.

- Hear from other people also investing - a personal part of it, personal experiences shared or examples so I might want to take those risks as well.

- Too much information: if it’s too much text, not encouraging. Maybe something I can click on if I want to, it will be better.

- A person should be responsible for decisions that are best for us but if you don’t know anything, then maybe a person can help you. The app can filter and I can choose for myself.

Results of Task 3

- All the participants had very different card sorting results.

- Some preferred setting up a savings plan as a good starting point while others preferred to see their transaction history or answering some questions to set up their profile.

- Most of the participants thought "Inviting friends and referrals" was the last step in the app interaction. Some even thought it was optional.

Results of Feedback

Requirements

Goal: The goal is to compile the design requirements from different sources from our UX process like Contextual inquiry, personas and scenarios. This helps to represent the target group and their needs which we can incorporate into our design of the app.

For requirements to be effectively implemented and measured, we tried to make them as specific, unambiguous and clear as possible. The aspect of user requirement is extremely significant to the exercise as the users’ inputs often carry the vital areas of improvement which either surface critical roadblocks or valuable insights about process optimization. The users' inputs combined with the app goals ensure that our design solution is relevant to your future needs.

Data Requirements

Information about the person who is interacting

- Name

- Age

- Occupation

- Salary (give a range—keep it optional)

- Environmental Values

- View on human Rights

- Employment status

- Consent/Privacy

Investor education & classification

- Test the users about the info they already know assign them a classification based on the info they know. Eg: Beginner- Investor, Advanced- Trader.

- Ask about- Risk Tolerance, Duration of investment, Investment goal, Investing experience and more.

- Give them the information based on how they answer the questions.

Information about investing opportunities, e.g. shares and/or companies

- Investors: Asset classes: Equity, Debt (Bonds), Funds (ETF, Mutual fund)

- Traders: Asset classes: Equity, Debt, Commodities (oil, gold, grains, silver), Funds (Mutual Funds, ETF, Derivatives), Alternative investments (Real estate, Private Equity, Hedge Funds).

- If you are a Trader then, you will also be shown instruments that include the component of leverage.

- Ask if they have a geographical preference (Do they want to invest in other countries or home country)

- Ask about ESG (Environmental Social Governance) preference: Companies with ESG structure are more environmentally friendly, their societal impact on the country etc.

Information about orders and transactions (buy or sell)

- Name of the Security they want to buy.

- Amount of shares.

- Type of order (Market price, Limit price) (functional).

- Order duration (End of day, End of time).

Functional Requirements

- Create Profile.

- Quiz for customizable information (risk tolerance, investment goal, experience).

- “User test” to classify how much information they know in order to categorize them to a specific user group.

- Classification.

- Classifying the level of the user tailored specifically for each group.

- Ranging from Beginner to Advanced.

- Manage/edit profile.

- User is able to change personal information, bank and cards, login & security, notification settings, help).

- View/Access Profile.

- Input bank information for stock buying.

- Users attach bank information in order to buy stocks.

- Amount of shares.

- Allows users to manage how many shares they would like to manage.

- Duration.

- Allows the user to choose how long they would like to invest.

- Manage stocks.

- Allows users to manage the lifespan of the stock.

Table of Requirements

|

User Stories

Goal: The user stories helped us turn all of information into sentences that highlighted the user’s needs and desires.

By following the format below, we created user stories based on multiple sources, namely our contextual inquiry survey and interviews and both focus groups.

- ID and Title

- role or function of the user (e.g. administrator)

- need(s) or wishes

- acceptance criteria.

These are all the User Stories:

- User is interested in valuable professional information to give him curated information.

- User wants to use a financial advisor in order to make financial decisions.

- User wants to have information, advice and actual investment in one app to make it more convenient.

- User wants to know about different types of investments so they can have diverse opportunities.

- User wants the information to look interesting to motivate them to read it.

- User wants few options that accommodate her needs and plans so she is not overloaded

- User wants access to all the sources of information so she has sources backing up advice the app gives.

- User wants to manage everything herself so she is in-charge of her decisions.

- User does not want technical information as it may be hard to understand.

- User wants to take medium risk as they want to grow by investing, not lose all the money.

- User wants to interact with the information at their own pace so they don’t get overwhelmed.

- User prefers an online chat or a chatbot so that language is not a challenge.

- User wants to have one app to do everything because it is more practical.

- User wants to have an How-To Guide on invest so it would be easier to go through the steps.

- User wants to look at how professionals invest to have trust.

- User wants to see stats and graphs because it helps to visualize their earning.

- User wants to have daily updates.

- User wants to get all kinds of information as much as possible from the company that he invests in.

- User wants to get informed how good his investment was and see the chart of his past investments.

- User wants to have an app as transparent as possible.

- User wants to have transparency in the app, but not much.

- User wants to get informed on how relevant the stock that he’s planning to invest is and the reasons why.

- User wants to have a warning if the stock is not beneficial to invest and be advised on alternative stocks to prevent users from making investment mistakes.

- User wants to know where information is coming from to build trust.

- User wants a chat box or a person to quickly clarify things.

- User wants to be asked about their investment advice based on own asessment and ethical standards knowledge.

- User wants to hear from other people about investing to make it more personal.

- User wants information to be structured/expandable to make it more clear.

- User wants to be in charge for investment decisions.

- User wants to get warnings about risks/ bad decisions.

The User Stories were then colour coded according to the topics they covered: chatbots and financial advisors, information sources, and investment decisions. These stories were then categorised based on similarities and contradictions.

Under contest:

- Information curated, few, not overwhelming, structured, versus all possible information

- Professionals investing for trust versus normal people investing to make it personal

No contest:

- Different types of investment

- Information to be structured and look interesting

- Statistics/graphs/charts of progress and past investments

- Where information is coming from

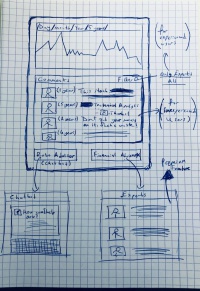

We tried making preliminary prototype sketches based on these user stories.

Use Cases

UC 1: Login / register

Actor: User

Precondition: None

Trigger: User wants to get advice on financial moves

Standard Procedure:

- User enters his/her informations

- User verifies his/her email

- User verifies his/her identity

- Attach bank account

Alternative procedure:

- Users skipped the process of verifying identity and complete registration.

- The identity will have to be verified later on if the user wants to use the app

Result: User successfully registered

Error procedure:

- System cannot verify user’s identity

UC 2: Create investment profile

Actor: User

Precondition: user logged in

Trigger: User wants to get a customized investment profile

Standard Procedure:

- System uses saved information from profile like nationality, age, occupation, etc...

- System asks some questions about duration

- Questions about risk tolerance

- Questions about ethical values

- System saves information about user

Alternative procedure:

- Standard non-individualized investment suggestions that work for most people

Result: Investment profile for user for suggesting investment options

Error procedure:

- Failure in proceeding

- Abortion by user

- System continues with a standard profile and suggests filling it later again.

UC 3: Getting more information

Actor: User

Precondition: user on page with information

Trigger: User wants to know where information is coming from

Standard Procedure:

- User clicks on ‘more info’

- Page view jumps to page with information source

- User can indicate at bottom of page of information was sufficient or not

Alternative procedure:

- Coming from information glossary or index

- Page displays all information source pages

- User clicks on one to view it

- User can indicate at bottom of page of information was sufficient or not

Result: Source of information is shown to user

Error procedure:

- Source of information not available or incomplete

- System displays error message

Actor: User

Precondition: User answers the questions and is categorised as ‘Investor” or ‘trader’.

Trigger: User activates function: Invest in Company A. (several triggers)

Standard Procedure:

- Systems shows 3 asset classes - Funds, Equity and Debt. System also gives help options.

- User chooses Equity

- System gives two options- search bar to look for companies of users choice & filter option to invest in specific companies.

- User types the name of the company on the search bar.

- Systems shows information about the share price, summary, Charts & stats, Analysis & Holders. System also shows two options- Buy & Help

- User clicks on buy.

- System transfers to the payment option.

Alternative procedure: User has no idea how to invest-

- User clicks on ‘Help’ option.

- System transfers to pages with information and other help.

Result: User successfully purchases the share.

Error Procedure:

- Payment Transfer unsuccessful or incomplete

- System does not display accurate information or the information the user wants.

- Overload of information or inability to understand etc leading to user not buying the share.

UC 5: Payment options

Actor: User

Precondition: User registers

Trigger: User activates function "Enter account details/Attach bank account"

Standard Procedure:

- Systems displays a bar to enter the account details and phone number attached to the account. System also displays a help option.

- User fills in the details and the phone number.

- System sends a verification call or text to the number entered.

- System offers options to add other accounts.

- System asks if the user wants to save the account details for future transactions.

Alternative procedure:

- User does not want to enter account details right after registration.

- System allows skip option

- Users can enter account details after selecting the shares to buy.

Result: User successfully entered the account details.

Error Procedure:

- System fails to send a verification text or call to verify the account.

Heuristic Evaluation

Team 4 Experts completed a Heuristic Evaluation on STASH!

Prototyping

Prototype Sketches

We used our User Stories to have some brainstorm sessions and took the time to come up with prototype sketches alone. We then shared our sketches with each other and used some of the ideas later in our digital prototypes.

Digital Prototypes

We used the Prototyping Software Pencil Project to create our interactive, digital prototypes, which we could upload and share as a website, for easier evaluation and testing. We went through eight improving iterations via internal heuristic evaluation and one after the usability testing.

Usability analysis

Testing

The aim of this procedure was to test how user friendly our product is. Users had to perform realistic tasks without any communication or assistance, every task was already predefined by us to assume that the testing was fair. We aimed to find what could potentially cause an issue while using an app, if anything important was missing and if the technical side of the application was working without any difficulties.

Tools: Zoom, Screen Recording

Participants: 3

Duration: 15 mins

Research questions:

Are the users able to perform the task efficiently and easily?

How consistent is the order of the app?

Method

Firstly, we introduced the app and gave a short information about what can the users expect from our testing process. Then, the participants were asked a permission and given the consent form in order to record the session. After receiving the consent form, we started with the tasks and asked them to think out loud during the tasks and observed them while using the app. After completing all tasks we asked them open questions in order to understand their insight such as “how was the experience?, “which one was the easiest/hardest task and why”. Furthermore, the participants were given more clarity about the app after the testing to help them visualise how the product would look like and get more information on what they think about it. Finally, we gave them a survey to get their final thoughts and gather the quantitative data needed to analyze.

Criteria & Evaluation Methods:

Time: Screen recording

Problems: Screen recording & thinking out loud

Self-Descriptiveness: Thinking out loud

Suitability for task: Observation

Perceived Satisfaction: Survey

Tasks

Login / Register

Create your investment profile

Upload the picture

Buy a share of Netflix

Survey

We prepared a survey to get the user’s final thoughts and feedback on the prototype, based on a quantitative scale that can be used to compare future prototypes with.

Tool: Google Form

Number of Questions: 9

Scale: Likert Scale

Questionnaire:

How difficult/easy was the app to use?

Was the App informative?

How easy/difficult were the tasks given to you?

How did you find the layout of the App?

How likely are you to use this App?

Were you satisfied with the information available?

Does the App meet your expectations?

How efficient was the App in meeting your needs?

Would you recommend this App to your friends/family?

Feedback / Suggestions

Evaluation

Post Testing Questionnaire Results

- All three users had different responses for almost all the questions.

- Some common trends were:

1. Usability testing tasks were easy

2. The app layout was simple.

- Feedback/ Suggestions:.

We received some insightful and critical feedback.

1. The users would like to have more interaction by typing in the text boxes.

2. The users found a couple of broken/ dead-end links.

3. The users would like to have a "Disclaimer" dialogue box whenever they enter their personal or financial information.

Qualitative Evaluation

- To evaluate the findings of the Usability Testing:

STEP 1: Enlisting the challenges.

For this, we created a table and listed all the challenges we witnessed our users face, as well as those mentioned by the users after the testing and in the survey sheet.

STEP 2: Colour coding the listed challenges

To classify the challenges according to their intensity, we color-coded them.

- Yellow: Cosmetic issues

- Green: Minor issues

- Orange: Major issues

- Red: Disasters

STEP 3: Brainstorming

In this step, we brainstormed for possible solutions to the challenges.

The prominent challenges were:

1. Security

2. Dead-end Actions

3. Confusing "Back" Button

STEP 4: Matching the solutions to multiple listed challenges

During the brainstorming session, we realized one solution can solve two to three of the challenges that our users faced.

STEP 5: Improving the app

The challenges coded in 'Yellow', 'Green', 'Orange' were easily solved by making minor changes to the app. Therefore, we decided to improve the app, a 2.0 version of the app.

Conclusion

Limitations:

- Simple layout of the prototype may have led to insufficient interaction between the platform and the user.

- The tasks for usability testing may have been too easy.

- Difference in the participation environments during Contextual Inquiry & Usability Testing.

- Participants in the Focus Group could have experienced peer pressure, intimidation by other participants, research bias, etc which could have caused hesitation among the users.

- Small sample size for Prototype Usability Testing.

InvestMATE 2.0

Keeping in mind the results of the usability testing, we made the following changes to the app.

- Corrected the dead-end actions.

- Added a keyboard that enabled the users to type in their information. Thus, making the app a little more interactive.

- Made changes to the options available for investing and getting investment-related information making it easier for our users to understand.

- Fixed the 'Back' option enabling the use to go back to the previous page.

Takeaways

- Learning UXNM in an online setting.

- Learning how to make an online application using User Experience Design.

- The different types of software available and using them to make the online platform.

- Working with people in a different time-zone, virtually.

- Conducting usability testings and focus groups online while making the best out of the current situation.

- Learnt the importance of heuristic evaluation before usability testing.

- Learnt to be patient and the importance of perseverance while making numerous changes to cater to the needs of the users.

Further Out-look

We believe strongly that by taking the right measures, efforts and keeping in mind the limitations and testing the app within a larger sample size, we have a solid idea here, which will bring value to our users.